Mobile

browsing

2019-04-11 12:18

October 30, 2018 - 09:02 BJT (01:02 GMT) MOFCOM

In accordance with the Anti-dumping Regulations of the People's Republic of China (hereinafter referred to as the Anti-dumping Regulations), on October 30, 2017, the Ministry of Commerce of the People's Republic of China (hereinafter referred to as the "Investigation Authority") issued Announcement No.67 of 2017, deciding to carry out anti-dumping investigation against imports of ethanolamines (or "EA", hereinafter referred to as the "Products under Investigation") originating in the United States, Saudi Arabia, Malaysia and Thailand.

The Investigation Authority has investigated into the existence of dumping and dumping margin, the existence of damage to China's domestic industry caused by the products under investigation and the extent of such damage, as well as the causal relationship between the dumping and the damage. According to the investigation findings and Article 24 of the Anti-dumping Regulations, the Investigation Authority released on June 16, 2018, an announcement on the preliminary ruling, affirming that there was dumping of EA originating in the United States, Saudi Arabia, Malaysia and Thailand and the domestic EA industry was substantially damaged, and there was causal relationship between the dumping and the substantive damage.

Upon the preliminary ruling, the Investigation Authority continued its investigation into the dumping and dumping margin, the damage and the extent of such damage, as well as the causal relationship between the dumping and the damage. The investigation now comes to an end. The Investigation Authority has made the final ruling (See the Annex) according to Article 25 of the Anti-dumping Regulations. Relevant matters are hereby announced as follows:

I. Final ruling

The Investigation Authority finally ruled that there was dumping of EA originating in the United States, Saudi Arabia, Malaysia and Thailand and the domestic EA industry was substantially damaged, and there was causal relationship between the dumping and the substantive damage.

II. Levy of anti-dumping duties

The Investigation Authority, in accordance with Article 38 of the Anti-dumping Regulations, proposed suggestions on the levy of anti-dumping duties to the Customs Tariff Commission of the State Council, which then decided, as of October 30, 2018, to impose anti-dumping duties on imports of EA originating in the United States, Saudi Arabia, Malaysia and Thailand.

Details of the product under investigation are as follows:

Scope of investigation: imports of EA originating in the United States, Saudi Arabia, Malaysia and Thailand.

Name of the Products under Investigation:乙醇胺 (including: monoethanolamine, diethanolamine, triethanolamine); name in English: Ethanolamines, or EA in short.

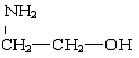

一乙醇胺, also known as 单乙醇胺, 2-氨基乙醇 or 2-羟基乙胺

Names in English:

Monoethanolamine, 2-Aminoethanol, 2-Aminoethyl alcoho (abbreviation:

MEA)

Chemical formula: H2NCH2CH2OH

Structural formula:

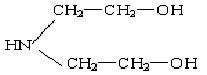

二乙醇胺, also known as: 2,2'-二羟基二乙胺, 2,2'-亚氨基二乙醇

Names in English:

Diethanolamine,2, 2'-Dihydroxydiethylamine, 2,2'-Iminodiethanol (abbreviation:

DEA)

Chemical formula: HN (CH2CH2OH)2

Structural formula:

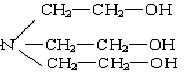

三乙醇胺, also known as 三(2-羟乙基)胺, 三羟基三乙胺

Names in English: Triethanolamine,

Tris(2-Hydroxyethyl) amine, Trihydroxytriethylamine (abbreviation:

TEA)

Chemical formula: (HOC2H4)3N

Structural formula:

Physical and chemical characteristics: EA is a general term of monoethanolamine, diethanolamine and triethanolamine. It is usually produced by reacting ethylene oxide with liquid ammonia. It is an alcoholamine organic compound that has partial chemical properties of both amines and alcohols. The appearance of EA is usually colorless to light yellow transparent liquid. Below the melting point, it is colorless to faint yellow solid, slightly amine-like, hygroscopic, soluble in water, ethanol, etc. and slightly soluble in benzene, ether and so on.

Main purposes: EA is mainly used in the production of surfactants, pesticides and pharmaceutical intermediates, household chemicals and personal hygiene products. It is also used as a raw material to make emulsifiers, fluorescent whitening agent VBL, oil refining (acid) gas treatment agents, cement grinding aids, cutting fluids, water reducing agents, industrial antifreeze, petroleum additives, leather softeners, lubricants resistance corrosives, anti-coking additives, etc. It is widely used in industrial cleaning, gas purification, pesticides and pharmaceuticals, household chemicals, textile printing and dyeing, construction materials, metal processing and other industries.

The products are listed under tariff numbers of 29221100, 29221200 and 29221310 (altered to 29221500 since 2017) in the Customs Import and Export Tariff of the People's Republic of China. Monoethanolamine salt under 29221100 and diethanolamine salt under 29221200 fall beyond the scope of this investigation.

Rates of anti-dumping duty imposed on companies are as follows:

Companies of the United States:

1. The Dow Chemical Company

76.0%

2. INEOS Americas LLC 97.1%

3. Huntsman Petrochemical LLC

97.1%

4. All Others 97.1%

Companies of Saudi Arabia:

1. SaudiBasic Industries Corporation

10.1%

2. All Others 27.9%

Companies of Malaysia:

1. PETRONASCHEMICALS DERIVATIVES SDN BHD/PETRONAS

CHEMICALS MARKETING (LABUAN) LTD 18.3%

(This tax rate applies only to the export of the Products under Investigation

produced by PETRONASCHEMICALS DERIVATIVES SDN BHD/PETRONAS CHEMICALS MARKETING

(LABUAN) LTD to China, and in any other case, the anti-dumping tax rate of "all

others" applies.)

2. All Others 20.3%

Companies of Thailand:

1. TOC

GLYCOL COMPANYLIMITED 37.6%

2. All Others 37.6%

III. Methods of

levying anti-dumping duties

As of October 30, 2018, import operators shall pay relevant anti-dumping duties to the Customs of the People’s Republic of China when importing EA originated in the United States, Saudi Arabia, Malaysia and Thailand. The anti-dumping duties shall be levied by means of ad valorem on the basis of dutiable value authorized by China Customs, and the formula is: anti-dumping duties = dutiable value authorized by China Customs * rate of anti-dumping duties. The import value-added tax shall be levied by means of ad valorem with the dutiable value authorized by China Customs plus the tariff and anti-dumping duties as the taxable value.

IV. Retrospective collection of anti-dumping duties

Deposits provided by relevant importers to the Customs of the People’s Republic of China from June 23, 2018 to October 22, 2018 according to the announcement on the preliminary ruling, shall be transferred on the basis of detailed description of commodities taxable and the rate of anti-dumping duties determined by the final ruling to anti-dumping duties, and the import value-added tax shall also be levied at relevant rate of value-added tax. Any excess of the deposits provided by importers during this period over the anti-dumping duties and the corresponding import value-added tax will be refunded by the Customs, and the short-levied duties will not be levied.

Anti-dumping duties are not retroactively imposed on imports of EA originating in the United States, Saudi Arabia, Malaysia and Thailand before June 12, 2018 (included) and during the period starting from October 23, 2018 and ending on October 29, 2018.

V. Period of levying anti-dumping duties

Imports of EA originating in the United States, Saudi Arabia, Malaysia and Thailand will be subject to anti-dumping duties for five years as of October 30, 2018.

VI. New exporter review

Any new exporter in the United States, Saudi Arabia, Malaysia and Thailand that does not export the Products under Investigation to the People's Republic of China during the investigation period, if qualified, may apply in writing to the Investigation Authority for a new exporter review according to Article 47 of the Anti-dumping Regulations.

VII. Interim review

During the period of levying anti-dumping duties, relevant interested parties may apply in writing to the Investigation Authority for review in light of Article 49 of the Anti-dumping Regulations.

VIII. Administrative reconsideration and administrative litigation

Any person who refuses to accept the final ruling and the decision on collection of anti-dumping duties may, according to Article 53 of the Anti-dumping Regulations of the People's Republic of China, apply for an administrative reconsideration or initiate litigation to the people's court according to the law.

IX. MOFCOM Announcement No.81 of 2018 on Final Ruling on the

Anti-dumping

Investigation against Imports of Ethanolamines Originating in the United States,

Saudi Arabia, Malaysia and Thailand takes effect as of October 30, 2018.

Ministry of Commerce of the People's Republic of

China

October 29, 2018